Apiture Service Terms

Last Updated: 23-April-2024

The Service Terms below are subject to the terms and conditions of the Master Services Agreement, SaaS Order or other agreement with Apiture (collectively, the “Agreement“) and govern the use of certain Apiture supported Services as of the Effective Date of the SaaS Order or other applicable digital banking Agreement with Apiture. By using the Services, you agree to be bound by the terms of these Service Terms. Capitalized terms used in these Service Terms but not defined below are defined in the Agreement. For purposes of these Service Terms, Institution understands and agrees that the obligations of Apiture with respect to the provision of the Services described in these Service Terms may be performed by a Third Party Provider contracted by Apiture to provide such services and Apiture disclaims any liability for the actions or omissions of its Third Party Providers; provided, however, Apiture shall use commercially reasonable efforts to enforce the terms of its agreement with the Third Party Provider in the event of a breach, failure to perform or otherwise for unsatisfactory performance. In the event of a conflict between these Service Terms and the terns of the Agreement, these Service Terms shall control with respect to the individual Service. These Service Terms may be modified by Apiture from time to time in its sole and absolute discretion, however, no modification of these Service Terms, except for those required to maintain compliance with Legal Requirements, will be binding until the Parties execute an amended or restated SaaS Order, Addendum, Schedule or Apiture otherwise provides written notice to Institution.

PART I: Institution Terms

Universal Terms

Institution will not create and will ensure no third party creates derivative works of or attempts to reverse engineer or recreate any of the products or services set out in these Service Terms by any means (whether by discovering or recreating underlying ideas, interface techniques, processes, or algorithms or by copying, modifying, translating, decompiling, or disassembling) or make any other attempt by any means to discover or obtain the source code or other proprietary information included in the Services, Apiture Systems, Software, Documentation or Third Party Provider products, systems, or any related service, other than the limited rights expressly granted in the Agreement. Institution will not and will ensure no third party directly or indirectly copies the Services, Apiture Systems, Software, Documentation or Third Party Provider products or systems, except as technically necessary to access and use the Services and Third Party Services in accordance with the Agreement and these Service Terms. Institution will not modify and will ensure no third party modifies the Services, Apiture Systems, Software, Documentation or Third Party Provider products or systems and will not remove, alter, cover, or obfuscate any proprietary rights notices therefrom. Institution will not conduct and will ensure no third party conducts penetration testing, load testing or vulnerability scans of any Third Party Provider products, systems or services without Apiture’s prior written consent. Institution will not attempt and will ensure no third party attempts to circumvent or disable any of the security features of the Apiture Systems or any Third Party Provider products or systems. Institution will not provide the Apiture Systems, Services, Software or Third Party Provider products or systems to any third party as a time-sharing service, service bureau, or consortium. Institution will neither disclose the results of any benchmarking of the Services, Apiture Systems, Software, Documentation or Third Party Provider products or system nor use such results for its own competing software development activities, without the prior written permission of Apiture.

- Bill Payment and Presentment Universal Terms

- Institution agrees, and agrees to require its Users (including business users), to use and receive the bill pay, bill presentment and related Services under this Section (Bill Pay Services) in accordance with Apiture’s and its Third Party Provider’s then-current terms and conditions, which will be presented in conjunction with the User registration process or otherwise upon written request.

- Institution shall indemnify Apiture and its respective Third Party Providers from, defend and hold each harmless from any loss, claim or liability incurred by Apiture or its respective Bill Pay Service Third Party Provider from Institution’s breach of its obligations to secure a User Agreement with each User in accordance with the Agreement. Compliance with Federal Reserve Bank Regulation E is the Institution’s responsibility.

- Institution shall provide content for any Bill Pay Service web subsite to Apiture in HTML format or will pay for such conversion of content to HTML at Apiture’s then-current hourly rate or at an otherwise agreed to, project-specific, price. Institution is responsible for providing all content in accordance with Third Party Provider development guidelines for the web subsite. Institution agrees that Institution-branded webpages for the Bill Pay Service, together with associated URLs and web addresses and the design elements and features for the webpages remain the exclusive property of Apiture and/or its Third Party Provider(s). Institution represents and warrants that it holds a valid copyright or license to any and all text and images it supplies for display on its Institution-branded webpages for the Bill Pay Service. Institution grants Apiture (and its Third Party Provider, if any) a non-exclusive, royalty-free license to display the text and images on the World Wide Web for this purpose for so long as the Agreement is in effect.

- Institution will provide Apiture with 90 days’ prior written notice of any material changes to its systems, and 20 days’ prior written notice for any minor changes requiring regression testing or testing of bill payment files.

- Subject to the terms in these Service Terms and the Agreement, Institution grants to Apiture and its Third Party Provider the non-exclusive right to use any Institution or User provided data to improve and enhance the Bill Pay Services or other services to Institution as well as develop data analytics models to produce analytics-based offerings that will be the sole and exclusive property of Apiture or Apiture’s Third Party Provider, as the case may be; provided, however, that this does not mean that Apiture or Apiture’s Third Party Provider is claiming any ownership of the underlying Institution or User provided data, which remain the property of the respective owners of such.

- CheckFree Bill Payment, Presentment and Fraudnet with Risk Assist (Retail Consumer and Business)

- When Users initiate a bill payment or bill presentment transaction through the Services, Institution acknowledges and agrees that the User’s Account will be debited via an Automatic Clearing House (ACH) debit or draft.

- Institution will provide to Apiture and its Third Party Provider, for the purpose of testing, certification and other non-production services or activities solely related to the Bill Pay Services, at no charge to Apiture or the Third Party Provider and at Institution’s cost and expense, such access to the Institution’s systems as may be reasonably required to perform the Bill Pay Services or supporting activities. Institution will obtain, at Institution’s cost and expense, any necessary third party authorizations or consents necessary for Apiture and its Third Party Provider to use and execute any Institution systems to the extent reasonably required to perform the Services. Notwithstanding anything to the contrary in the Agreement, Apiture shall not be required to use or execute any Institution system if Apiture reasonably believes that the use or execution of such Institution system would constitute an infringement of the intellectual property rights of any third party.

- The Third Party Provider will have the right, in its sole discretion, to deny Bill Pay Services to any User that has not completed the required user registration process or indebted to the Third Party Provider in connection with other bill payment services or transactions, including, but not limited to, services provided through another financial institution. Apiture will notify Institution via e-mail the following business day of any application concluding in a denial of service.

- Institution shall maintain editorial control over and be solely responsible for maintaining its web site and providing access through it to the Services and shall be solely responsible for regulatory compliance of its web site and its functionalities with all applicable federal, state and local laws, rules, and regulations.

- Institution shall provide copyright attribution to Apiture’s Third Party Provider as creator and designer of the web subsite and graphical user interface by preserving the Third Party Provider’s copyright legends wherever appropriate based on the unique and specific nature of the web subsite.

- Institution shall be responsible for registering and maintaining registration of its Internet domain name address.

- The risk override or similar feature allows Institution to provide and to permit its Users to override Apiture’s Third Party Provider’s risk processing rules, and to assign a modified risk limit for that User, be it above, below, or the same as Apiture’s Third Party Provider default limit specified on the Third Party Provider’s system. In utilizing and allowing the risk override or similar feature, Institution acknowledges and agrees that it is financially responsible for and guarantees the full dollar amount of transactions that such User or other users transact through all impacted Bill Pay Service(s) within the risk limits selected by Institution or its User without any financial contribution from Apiture or its Third Party Provider, and agrees to fund Apiture or its Third Party Provider the full amount of transactions up to the modified risk limit regardless of the availability of funds in such User’s account. Notwithstanding the foregoing, if any risk override or similar feature has been invoked for a User for at least one transaction type, but a risk limit has not been specified for other transaction type(s), then Institution will still be financially responsible for the full amount of all transactions of all types, up to the default risk limit established by Apiture’s Third Party Provider risk processing rules regardless of the availability of funds in such User’s account.

- The Institution hereby accepts the risk for, as well as any fraud and chargebacks associated with, any and all User enrollments and transactions in the Bill Pay Services and shall additionally indemnify and hold harmless Apiture from any and all liability, including reasonable attorneys’ fees, arising from the failure of the User to have adequate funds available as a result of fraud or otherwise, including but not limited to any liability Apiture may incur to the Third Party Provider as a result of the User’s use of the Bill Pay Services.

- Institution will use commercially reasonable efforts to make corresponding changes to its systems to use the then-current release of the applicable Bill Pay Service, but in any case, will not be on any release of the applicable Bill Pay Service after such release is discontinued by Apiture’s Third Party Provider. Each release of the Bill Pay Services will be provided for at least 24 months after making such release generally available to Apiture’s clients of the applicable Bill Pay Service. Apiture will inform Institution at least 2 months prior to discontinuing a release of the Bill Pay Services, unless required to discontinue earlier for security or legal reasons. If Institution is in violation of the first sentence of this section, then Apiture and its Third Party Provider reserve the right to upgrade Institution to a release of the Bill Pay Services that complies with such sentence. All feature packs for the Bill Pay Services are mandatory and will be placed into production when made generally available to all Apiture clients for the applicable Bill Pay Services, with the sole exception of any specific functions within a feature pack that require a separate written agreement between Apiture and Institution for any fees for such function.

- Apiture’s Third Party Provider shall be responsible for Transaction Losses (defined below) solely to the extent that the debit of a User’s account for the transaction was returned for an insufficient available balance from the User regardless of funding method (e.g., NACHA Reason Codes R01 (Insufficient Funds) or R09 (Uncollected Funds)), but not if due to a closed or frozen User account or due to an unauthorized or fraudulent transaction. Apiture’s Third Party Provider will have the right to collect funds against such Transaction Losses for which it is responsible. Institution shall be responsible for all other Transaction Losses regardless of the amount or circumstance of the Transaction Loss. Without limiting the preceding sentence, Institution will research complaints that it receives from any User that an unauthorized transaction has occurred through the Bill Pay Services, and for funding any Transaction Losses or other amounts due Users or another party resulting from such unauthorized transaction. As part of the Bill Pay Services, neither Apiture nor its Third Party Provider is in any way responsible for authenticating User credentials for access to the Bill Pay Services. Institution acknowledges that with respect to the Bill Pay Service transactions, Institution or its User is the originator under the ACH Operating Rules. Institution, Apiture and its Third Party Provider agree to notify one another in the event of fraud being investigated by either party as it relates to the Bill Pay Services; such notification should be made within 2 business days of the party learning of the issue. In the event notice is prohibited by law enforcement or another government entity, then Institution will provide notice to Apiture as soon as practicable or permissible thereafter. “Transaction Loss” is a loss that occurs because the associated Bill Pay Services transaction was rescinded as unauthorized or has been returned and is un-collectable.

- Institution agrees to work in a commercially reasonable manner with Apiture’s Third Party Provider’s customer care center for first tier customer support for Bill Pay Services. Institution and Apiture’s Third Party Provider shall establish clear escalation criteria and processes whereby the Third Party Provider’s customer care may transfer, escalate, or turn over User related questions which do not directly deal with Bill Pay Services back to the Institution. These areas include, but are not limited to, technical and application support, general banking or bank account questions. Institution must use the Third Party Provider’s customer care system for any escalation by placing claim in urgent status. If expectations are still not met, Institution must contact the Apiture relationship contact. The Third Party Provider will provide management of merchant relationships; manage the Third Party Provider’s merchant database, process payments as instructed by Institution and its User, and will research payment posting discrepancies with the payees and use commercially reasonable efforts to support problem resolution in accordance with the Third Party Provider’s then-current standard practices.

- Neither Apiture nor its Third Party Provider is responsible for any risk (including without limitation, any User claims) associated with services which Institution requests that Apiture or its Third Party Provider copy a User account to a different account.

- Institution acknowledges that with respect to services transactions resulting in ACH Payments, Institution is the Originator under the NACHA Rules (defined as the National Automated Clearing House Association Operating Rules and Guidelines) for ACH payments that a subscriber submits for processing and Institution will have all responsibilities and liabilities of an Originator under the NACHA Rules for such ACH payments.

- Institution and Fiserv will be Third-Party Senders (as defined in the NACHA Rules) with respect to such ACH Payments and will have all of the responsibilities and liabilities of a Third-Party Sender under the NACHA Rules with respect to such ACH payments. Institution will comply with all applicable NACHA Rules and will not originate transactions in violation of any applicable law.

- Institution will not itself act as a Third-Party Sender on behalf of any other Originator under the Agreement without Apiture or Fiserv’s prior written consent. Apiture or Fiserv may withhold consent for any reason, including in circumstances in which the Originating Depository Financial Institution (“ODFI”) (as defined in the NACHA Rules) utilized for the Services does not provide consent.

- Fiserv will facilitate processing ACH Payments submitted by subscribers by transmitting ACH files to one or more ODFIs that has agreed to originate ACH payments for the Service. Institution authorizes Apiture and Fiserv and the ODFI to originate entries on behalf of Institution to the accounts designated in the Payment Instructions (defined as the information for a payment to be made for the service). When Fiserv receives a Payment Instruction, Institution authorizes Apiture and Fiserv to debit the subscriber’s account for the amount of any such Payment Instruction plus any related fees in effect (and as disclosed by Institution to the subscriber) at the time the subscriber initiates the Payment Instruction, and to remit funds on Institution’s behalf. Institution also authorizes Apiture and Fiserv to credit the subscriber’s account for the receipt of payments, including but not limited to those payments returned from receivers to whom the subscriber sent payment(s) and those payments that were cancelled and returned to the subscriber because the processing of the Payment Instruction could not be completed.

- During the term of Institution’s Agreement and for a period of one (1) year following termination or expiration, Apiture or Apiture’s Third Party Provider , the ODFI or an independent third party selected by Institution will be entitled, following reasonable advance written notice to Institution, but not more than once during any calendar year, to audit the books and records of Institution wih respect to verifying compliance with the terms and conditions of this Section. Any such audit will be conducted during regular business hours, and in a manner so as not to unreasonably interfere with Institution’s business operations.

- If Apiture or its Third Party Provider reasonably believes that any Services, or an Institution’s or any subscriber’s conduct in using the Services (including without limitation any subscriber intentionally initiating fraudulent or unauthorized transfers, account access or violating any agreement under which it has been provided access to the Services) violates these Service Terms or any applicable laws, rules, regulations or industry standards, or otherwise poses a threat to Apiture’s or its Third Party Provider’s system, security, equipment, processes, intellectual property or reputation (“Threatening Condition”) and if, in the reasonable and good faith determination of Apiture or its Third Party Provider, the Threatening Condition poses an imminent or actual threat (including without limitation regulatory investigation, inquiry or penalty), Apiture or its Third Party Provider may suspend any and all of Institution’s use of the applicable Services until such Threatening Condition is cured. Apiture will promptly notify Institution of such suspension, including the identity of the affected Subscriber(s) as needed, and both parties will use reasonable efforts to cure or cause the correction of the Threatening Condition following such notice. Apiture may terminate Institution’s and/or subscriber’s use of the Services without further requirement of notice if the Threatening Condition remains uncured more than thirty (30) calendar days after Fiserv notifies Apiture and Institution the Threatening Condition.

- With Fraudnet with Risk Assist, an alert will be generated for each online bill payment or consumer payment that scores as a suspect payment. The Fraudnet team will monitor and evaluate all alerts and communicate with either the Institution or initially the bill pay subscriber when required to confirm the payment was submitted by the subscriber. Fraudnet will send an alert notification to Apiture and the Institution when these occur.

- The Fiserv Checkfree bill discovery service enables the automatic searching, identification, and retrieval of information about a subscriber’s payees and bills based on matching information about the subscriber’s identity. As part of the bill discovery service, a Fiserv-approved consent is required for each subscriber to authorize the access and use of information from the subscriber’s consumer report from a credit bureau, and Fiserv’s biller network to perform the bill discovery service.

- Insights Assist is a self-service reporting option that offers the ability for Institution to access and run reports without engaging Apiture or its Third Party Provider. A Subject Area is a group of reporting content with similar data (such as, but is not limited to subscriber activity), presented in one dashboard containing key metrics about the Subject Area, including reports that are pre-developed by Apiture’s Third Party Provider as well as a business objects universe in the dashboard which can be used by Institution to create custom reports. To gain access to a Subject Area Institution must contact Apiture in writing. Institution will then be billed for a minimum of twelve (12) months after enabling each specific Subject Area and will continue to be billed monthly for each such Subject Area until Institution provides 30-day written notice to Apiture to discontinue access to a Subject Area.

- The Business Bill Pay Services shall specifically provide the following features and functionality to Business Bill Pay Service Users:

- The web subsite will facilitate the transfer of an encrypted account number and PIN data from the Institution’s host system for verification, if required.

- Business Bill Pay Service Users can pay anyone from anywhere in the U.S., twenty-four (24) hours a day, seven (7) days a week. Business Bill Pay Service Users can also schedule payments up to one (1) year in advance.

- Business Bill Pay Service Users can initiate and authorize payments from their accounts to payees who have selected in advance to receive payments by means of the Bill Pay Service. Business Bill Pay Service Users will have the option of setting up payments as one of two bill payment types. (1) recurring; or (2) single. Recurring payments are payments of a fixed amount paid on a regular time interval, such as, but not limited to, monthly rent or mortgage payments; once a recurring payment is set up by the Business Bill Pay Service Users, the Business Bill Pay Service will automatically execute bill payments according to the Business Bill Pay Service User’s instructions until the Business Bill Pay Service User cancels or changes those instructions. Single payments are payments that vary in amount and/or date, such as, but not limited to, utility or credit card payments. Once a single payment is set up by the Business Bill Pay Service Users individually, the Bill Pay Service will execute the bill payment instructions according to the Business Bill Pay Service User’s instructions for each individual payment.

- The Business Bill Pay Service User can select from a pre-defined list of billers to receive electronic bills. Once the Business Bill Pay Service Users has activated the bill delivery service for a biller, the Business Bill Pay Service User will begin to receive future bills electronically within the Bill Pay Service.

- Business Bill Pay Service Users are permitted to transfer funds between accounts activated for the Bill Pay Service. The Bill Pay Service will execute such account transfer requests for each individual account transfer request.

- The Bill Pay Service provides two-way messaging which allows Business Bill Pay Service Users to send and receive messages regarding the bill payment service from the Third Party Provider’s customer care service.

- The Bill Pay Service provides a list of the Business Bill Pay Service User’s payments scheduled and processed.

- The Bill Pay Service allows Business Bill Pay Service Users to utilize multiple accounts as activated payment accounts. When scheduling payments, the Business Bill Pay Service User may make a payment from any activated payment account.

- Except as set forth in Section 1.1.11 hereof, Institution will be responsible for managing all contact with Business Bill Pay Service Users. This includes but is not limited to, sales, training, implementation, customer care, system support, customer disclosures required by applicable laws, rules and regulations and communications, including but not limited to communicating then-current terms and conditions of Bill Pay Service stipulated by Apiture’s Third Party Provider.

- iPay Bill Payment and Presentment (Retail Consumer and Business)

- Apiture’s Third Party Provider may decline to provide Bill Pay Services to any Institution whose financial condition is not satisfactory to Apiture or its Third Party Provider in its/their reasonable, sole discretion; provided that should Institution believe its financial condition is suitable for providing Bill Pay Services, Institution will be required to provide a written guarantee from a documented, financially suitable third party (co-signer) of all obligations arising in connection with the Agreement, including payment of all charges for Bill Pay Services and Apiture will provide the Bill Pay Services.

- Prior to using the Bill Pay Services, Institution agrees that Users must enroll in the service. Institution is responsible for ensuring that the identity of Users has been authenticated pursuant to “know your customer” requirements and for OFAC screening of Users prior to making the Bill Pay Services available to them. Institution is responsible for the selection and use of user authentication techniques and other security features available through the Bill Pay Services and other sources. Neither Apiture nor its Third Party Provider shall be liable for fraudulent and otherwise unauthorized access to and use of the Bill Pay Service.

- The Institution agrees to install with each individual User one or more agreements, which contain, without limitation, (i) the User’s authorization to allow Institution to provide the Bill Pay Services to User; (ii) legally required disclosures; (iii) the User’s authorization for Institution to originate ACH entry debits to the User’s account; and (iv) authorization for Apiture’s and its Third Party Provider to access and retrieve information in the User’s biller accounts. Institution will deliver evidence of those authorizations to Apiture (or its Third Party Provider) upon written request.

- For any Institution billing files provided to Institution, Institution is responsible for the timely receipt and posting of the payment file. Cancellations must be complete before the cancellation cut off time.

- Payments scheduled prior to the established cut-off time on Business Days will be processed on that day. Apiture’s Third Party Provider processes these transactions and prepares debit files for the Institution to cover funds for bill payment transactions, which the Institution processes through its core system. Institution acknowledges that User payments are remitted through various partners, iPayNet (a proprietary payment gateway), ACH, or by printed check. Apiture’s Third Party Provider seeks to remit payments in the least costly, most efficient manner possible. Institution agrees the User is responsible for scheduling the payments to arrive at the payee no later than the bill’s actual due date by specifying the payment date in the payment instructions. The estimated delivery date is provided as a guide and is not guaranteed. Payments scheduled after the cutoff time or on non-Business Days will be considered entered in the Bill Pay Service on the next Business Day. Institution may cancel payments through the master site prior to the established deadlines.

- Whenever a User activates the eBill service for a particular biller, the User will be required to provide information necessary to access the User’s account with such biller, such as login credentials for that biller’s web site. The eBill service will use this information to regularly log into the User’s account at the biller’s site and extract information regarding the User’s most recent statement in order for the eBill Service to present this information to the User in conjunction with the Bill Pay Service. If a User does not have complete and accurate access information for a biller’s site, or if they are unwilling to provide this information to Apiture, then that User cannot use the eBill Service for that biller and Apiture and its Third Party Provider have no liability for any delays or failure to transact with that particular User’s biller. The eBill service is made available only as an integral part of the Bill Pay Services.

- The eBills/eBill Presentment Service includes the use of Data Analytics. “Data Analytics” means: (i) monitoring click activity (via tagging) of any eBill landing page that allows an end user to view eBills for an individual biller, and (ii) monitoring click activity (via tagging) of an embedded digital ad graphic so that biller may learn whether an eBill ad graphic appearing on its eBill landing page was clicked by an end user. No account or other personal information shall be collected and the use of the data shall be purely for collecting click events. Institution agrees to (a) provide Apiture written authorization to share anonymized Data Analytics results with iPay, iPay’s third party service providers, their permitted assigns, and their sub-contractors, agents and applicable eligible biller(s), and (b) comply with all applicable state and federal privacy, data security and user tracking laws.

- For as long as Apiture offers and supports a Hybrid Risk Model of funding Bill Pay Service transactions, the Institution may elect to process bill payment transactions using the Hybrid Risk Model where electronic payments are debited from the User’s account on the delivery date and all checks are drawn on the User’s account and clear when presented to the payee’s financial institution (Hybrid Risk Model). If Institution elects for the Bill Pay Services to be performed using the Hybrid Risk Model, then Institution agrees it is responsible for and shall indemnify, defend and hold Apiture harmless from claims arising from, the setting of the daily and monthly electronic processing risk limits which applies to electronic payments. Institution acknowledges that electronic payments always pay electronically unless the payment exceeds the risk limit established by the Institution and in that instance the payment is converted to a check for that specific transaction. When a User submits an electronic payment that exceeds the risk limit established by the Institution, the User must be advised by the Institution that the payment needs to be delivered as a check drawn on the User’s account. The User then has the option to either accept a conversion of the payment to check, or to cancel the payment. In addition to the existing payment limits (max transaction cap, email payment transaction cap, and the email payment processing cap), two new User limits are available: a daily maximum and monthly maximum processing dollar amount for electronic transactions. If a scheduled or edited electronic transaction causes either one of the maximums to be exceeded, the Institution acknowledges the transaction will be sent as a check. The Institution is responsible for setting daily maximum and monthly maximum dollar amount payment limits and manages those limits globally or at the individual User level. The existing global or individual User level limits for each electronic transaction and email payment (P2P) will still be validated before the new limits described above are invoked. All electronic payments are subject to the electronic risk limits established by the Institution and when any transaction exceeds the limit, the transaction is converted to a check. Users are notified of this conversion during the online session as the consumer Bill Pay interface prompts the User to provide a remittance address to use for that specific transaction. In addition, Institution may control the decision on Non-Sufficient Funds (NSF) fees and uncollected fees. The Institution is responsible for deciding its risk tolerance per User and setting limits accordingly based on its own assessment of the particular User. Real-time reporting provided by Apiture gives the Institution an opportunity to assess its risk tolerance relating to those Users exceeding established risk limits and thereby gives Institution the power to adjust its Users’ individual risk limits. In using this Hybrid Risk Model, Institution acknowledges that it retains all liability for all unfunded payments. An unfunded payment is defined, for the purpose of these Service Terms, as any electronic bill payment the Institution could not post due to any reason, including, but not limited to: insufficient funds, closed account, frozen account, etc. Check payments are drawn on the User’s account with Institution and the Institution has the option to honor the check and can also assess NSF or uncollected fees to the User. If Institution elects to operate under the Hybrid Risk Model, Institution understands that Institution will not have the opportunity to review and cancel payments.

- For as long as Apiture supports and Institution engages in the Good Funds Model of funding consumer/retail Bill Pay Service transactions, the Institution may elect to process bill payment transactions under the Good Funds Model where payments will be held overnight (Good Funds Model). For this funding model, the Institution has the ability to cancel electronic payments within designated timeframes but may not return any debits for electronic bill payments processed. Check payments may be drawn on accounts at Apiture (or its Third Party Provider’s) and settled with the Institution, enabling the Institution to cancel payments before they are paid. Alternately, check payments may be drawn on the User’s account enabling the Institution to clear the item once it is presented to the Institution.

- For as long as Apiture supports and the Institution engages in the Funds Verification Model, Apiture’s Third Party Provider is allowed to verify funds’ availability for electronic payments and hard post the debits for bill payments to the User’s account with the Institution on the same day the payment is processed (Funds Verification Model). This Funds Verification Model is only available for Institutions on a Jack Henry & Associates banking core platform (SilverLake, 20/20, or Core Director). Check payments can only be drawn on the User’s account with Institutions having the option to clear the item once it is presented to the Institution. Stop payments may be placed by the User within internet banking. Institution acknowledges that User fees for expedited payments, gift pay or bill pay do not go through the same funds verification process.

- Notwithstanding Apiture’s obligations in the Agreement to utilize commercially reasonable information security procedures and encrypt data and accept encrypted data, neither Apiture nor its Third Party Provider guarantees that data submitted through the Internet will be secure from unauthorized access or will be free of errors or omissions due to Internet transmission.

- Institution acknowledges that as of the effective date of the Agreement, the Third Party Provider’s data centers are hosted by Jack Henry & Associates, Inc. If, at any time Apiture’s Third Party Provider decides to utilize an unaffiliated service provider for that function then Apiture’s Third Party Provider has the option to do so as long as Apiture is given the opportunity to perform due diligence, including a security risk and technical and operational audit of the new service provider. If Apiture and its Third Party Provider cannot mutually agree on remediation and mitigation if Apiture determines the new service provider exposes Apiture and/or Institution to security or compliance risk, then Apiture may terminate the Bill Pay Services. Institution acknowledges that such termination will be Apiture’s sole remedy for its Third Party Providers substitution of its data center service provider.

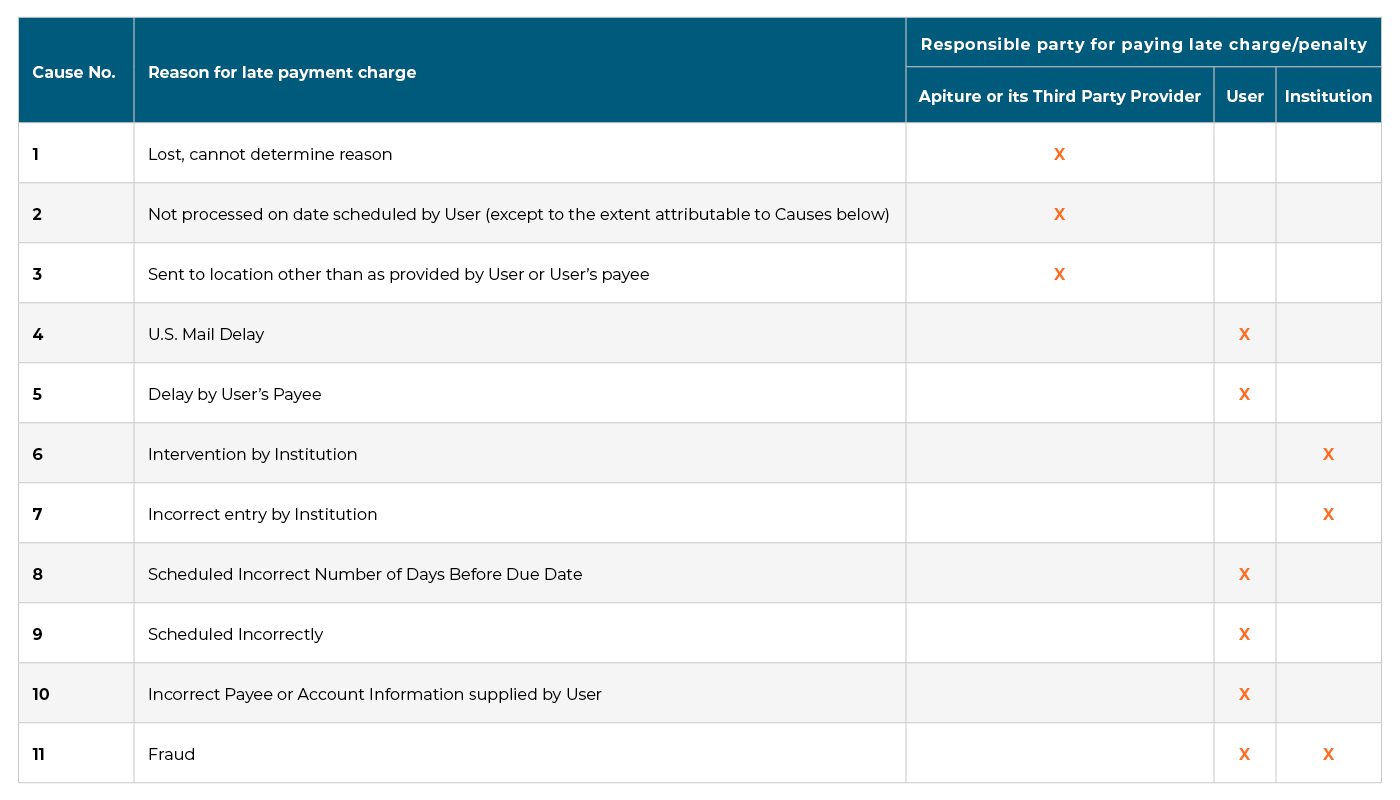

- Where a User meets the requirements of this Section and a User’s bill payment transaction is not processed or is delayed as the result of an error by Apiture or its Third Party Provider, Apiture or its Third Party Provider will be responsible to the Institution for the amount of any late charges actually incurred by the User up to $50.00 in accordance with the below. Institution and/or User will otherwise be responsible as follows:

In the event Apiture or its Third Party Provider is responsible for a late charge/penalty according to the above chart, Apiture (or its Third Party Provider) will either (i) contact the payee to have the late fee/penalty waived or (ii) reimburse Institution for the late fee/penalty, up to Fifty Dollars ($50.00) for each late payment where the User provided Apiture with complete and accurate payment instructions and scheduled the payment to process at least five (5) Business Days prior to the payment due date to allow for proper and timely receipt by the payee. Late fees/penalties will not be reimbursed by Apiture or its Third Party Provider for payments not initiated at least five (5) Business Days prior to the payment due date. - Institution shall be responsible for, and defend, hold harmless and indemnify Apiture, its Affiliates, and any Third Party Provider from against all claims by a User relating to the authorization of Apiture (and its Third Party Provider, if any) to provide Bill Pay Services on behalf of the User as well as the attendant results from the provision of the Bill Pay Services including but not limited to insufficient funds, repudiation of authorization for payment, fraud on the User’s account, and, except as set forth in the preceding paragraph, late fees. Apiture (and its Third Party Provider, if any) will incur no liability because of the existence of any one or more of the following circumstances: (a) if, through no fault of Apiture (or its Third Party Provider, if any), any designated User account from which funds for bill payments are deducted does not contain sufficient funds to complete the transaction and is cancelled by the Institution; (b) the Services are not working properly and the Institution knows or had been advised by Apiture (or its Third Party Provider, if any) through the communication method of its choosing about the problem before the User executes the transaction; (c) the payee to whom an User designates a bill payment to be delivered mishandles or delays processing a payment sent by Apiture (or its Third Party Provider, if any); or (d) a User has not provided Apiture (and its Third Party Provider, if any) with the correct name, address, phone number, or account information for the payee, or a User has not provided Apiture (and its Third Party Provider, if any) with accurate personal information, of a User or has otherwise provided incomplete bill payment instructions.

- Institution will notify Apiture as soon as commercially practicable, but in no event later than 1 Business Day, if Institution becomes aware that any user is materially breaching its terms and conditions with respect to the Bill Pay Services. Apiture reserves the right to charge for research time in connection with investigation of disputed payment transactions. Institution remains liable for all fraudulent losses, including chargebacks.

- On a daily basis, Apiture’s Third Party Providers’ financial institution will originate an ACH debit entry to Institution to collect the funding for the bill payments initiated by Institution’s Users. Institution may not return such ACH debit entry for any reason. As soon as notice is provided to Institution that any debited funds have been returned, Institution shall immediately wire to a designated account at Apiture’s Third Party Provider’s financial institution on that same day immediately available funds in the amount of any returned ACH debit entry. All bill payment funds held overnight will be held in overnight investment accounts and any interest on such funds will be paid to Apiture’s Third Party Provider as part of its compensation for the Bill Pay Services.

- Should an error occur with the Bill Pay Services, if directed by Apiture, Institution will take all steps reasonably necessary to carry out procedures for resolving errors or malfunctions within a reasonable time after such procedures have been received from Apiture and/or its Third Party Provider. Institution is responsible for assisting with returns and exception handling, without limitation, providing Apiture and/or Third-Party Provider with access to User’s information to duplicate and resolve errors. Apiture and its Third Party Providers shall not be responsible for errors caused by Institution, Users, or billers. Apiture reserves the right to charge for research time in connection with investigation of disputed payment transactions.

- If Institution purchases Apiture’s Third Party Providers’ Compliance Package, then a daily report of potential OFAC SDN List matches of payees is made available to Institution on the site software. Institution is responsible for reviewing the report daily and determining whether to block any payment transactions.

- Metavante Bill Payment and Presentment (Retail Consumer)

- Institution will provide any computer and communications hardware and related software required at its location(s) including its own internet access services, for Institution’s use in accessing the administrator module on Apiture’s Third Party Provider’s website via the internet in support of its User and Institution service obligations.

- Institution is responsible for migrating existing customer data to Apiture’s Third Party Provider database and the User is responsible for the accuracy of account and other information required for accessing User bills.

- Institution agrees to cooperate with Apiture or its Third Party Provider and provide Apiture or its Third Party Provider with all necessary information and assistance required for Apiture and its Third Party Provider to successfully make the Bill Pay Services operational and available to Institution. Institution agrees that Apiture or its Third Party Provider is under no obligation to provide any User with access to the Bill Pay Services unless and until Institution has provided Apiture or its Third Party Provider with all information and documentation required by Apiture or its Third Party Provider for User set-up. Apiture and its Third Party Provider will not have the contractual relationship with Users, and so must rely upon Institution to manage liability and risk issues. Institution will include appropriate provisions in its User Agreements regarding, and shall indemnify Apiture and its Third Party Provider from, defend and hold each harmless from claims arising from: (a) any User’s use of or inability to use the Bill Pay Service, specifically including, without limitation, any User’s claim for late charges or other economic loss or damages arising from the User’s use of the Bill Pay Service, (b) transactions effected with a lost, stolen, counterfeit or misused access code or identification number issued to any User; and (c) any payments initiated by a User which are not completed due to lack of funds in the User’s settlement account.

- Institution understands that it is fully responsible for the availability of good funds necessary to settle the bill payment activities of Users initiated through the use of the Bill Pay Services. Apiture’s Third Party Provider shall initiate debit ACH entries against each User’s designated account for bill payment activities initiated by the Use. Institution is and shall remain solely and exclusively responsible to Apiture for the entire amount of any bill payment processed for and on behalf of a User in accordance with instructions received through the Bill Pay Services and which is not funded by the User due to insufficient funds in the applicable depository account or for any other reason outside Apiture’s or its Third Party Provider’s control. A description of Apiture’s Third Party Provider’s collection procedures as of the date of these Service Terms is set out herein. Apiture’s Third Party Provider reserves the right to modify its collection procedures from time to time. Neither Apiture nor its Third Party Provider shall be responsible for losses with government payments. Institution shall be exclusively responsible for and, upon Apiture’s demand, reimburse Apiture for, the amount of any government payments which Apiture or its Third Party Provider reasonably believe it cannot collect from the User for any reason.

- Apiture’s Third Party Provider reserves the right to set and change its User support policies, procedures and availability as they apply to all users of its service (not just Institution’s Users) without the consent of Institution.

- Institution remains liable for all fraudulent losses, including chargebacks.

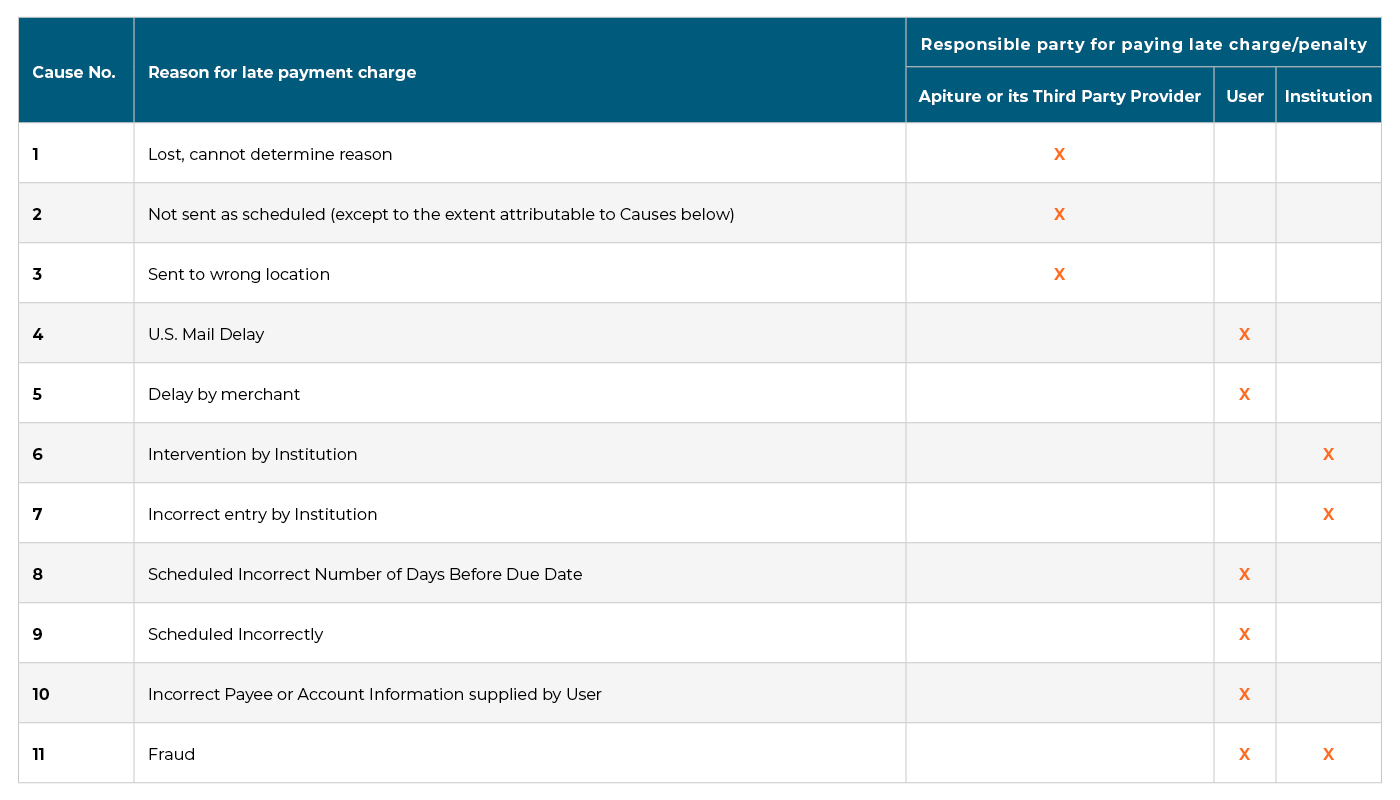

- Where a User meets the requirements of this Section and a User’s bill payment transaction is not processed or is delayed as the result of an error by Apiture or its Third Party Provider, Apiture or its Third Party Provider will be responsible to the Institution for the amount of any late charges actually incurred by the User up to $50.00 in accordance with the below. Institution and/or User will otherwise be responsible as follows:

In the event Apiture or its Third Party Provider is responsible for a late charge according to the above chart, Apiture (or its Third Party Provider) will reimburse any payee-imposed late fees, up to $50.00, incurred by any User; provided that the User provides Apiture with payment instructions 5 business days prior to the due date to allow for proper and timely receipt by the payee. Late fees or penalties not initiated at least 5 business days prior to the due date will not be reimbursed by Apiture or its Third Party Provider. - Payment instructions, paper bill images and e-bill images will be available for 12 months after which they will be purged, however, Apiture’s Third Party Provider will research and provide a response to User inquiries on transaction data and bill images for a period up to 7 years after the date of the transaction.

- Check payments will be issued using Apiture’s Third Party Provider’s Trust Check drawn on its bank account. All U.S. Postal rate increases will be passed-through as actual costs to Institution with or without prior notice.

- Payment transaction data and bill images will be stored and made available online for Users and Customer Service Tool (CST) users to view for a period of 24 months. Payment transaction data and bill images older than 24 months may be purged provided, however, Apiture’s Third Party Provider will research and provide in response to all User inquiries transaction data and bill images for a period up to and including 7 years after the date of the transaction.

- Apiture and its Third Party Provider will maintain check images for no more than 90 days after the check has cleared.

- Payrailz Bill Payment, P2P and Fraud Monitor

- Institution’s right to use the Payrailz Bill Payment, P2P and Fraud Monitor Services (each, a “Payrailz Service”) is limited only to the use by its authorized clients and customers (PR Users) and not for further resale, relicense or other use by third parties and only at the sites and for the purposes specified in the Apiture Agreement.

- Certain portions of the Payrailz Services will be implemented and maintained by a third party provider of the Payrailz. Specifically, the following terms and conditions apply with respect to the Instant Account Verification Service. “Instant Account Verification Service” means those certain account authentication services and any other services provided in connection with the Payrailz Services that are provided by the Payrailz third party, Plaid, Inc. or its successor (“Plaid”). Notwithstanding anything herein to the contrary, client data entered into the Payrailz Services by a PR User in connection with the Instant Verification Information for purposes of these Service Terms shall not be Confidential Information and shall be maintained and processed by Plaid in accordance with Plaid’s privacy policy (currently available at www.plaid.com/legal). Institution shall provide all notices and obtain all consents required by law from PR Users for Plaid to process PR Users’ data in accordance with Plaid’s privacy policy (currently available at www.plaid.com/legal), which may be accomplished by including the provisions in the PR User license agreement as specified in Part II, Section 5 of these Service Terms.

- Institution agrees to make its facilities, personnel and information available to Apiture and/or Payrailz, as applicable, in a timely manner to permit the scheduled activities in accordance with the project plan. Institution’s failure to timely complete its required tasks, responsibilities or approvals may result in delay of the implementation and use of the Payrailz Service and Institution shall be solely responsible for any additional costs resulting from Institution’s delay or failure to provide the resources necessary.

- Any material changes to timing, deliverables or pricing under the project plan including, but not limited to, delays resulting from a failure of the Institution to timely meet its obligations under the project plan shall be set forth in a change order form and agreed to by the parties. Once the change order form is executed, the project plan will be amended as provided therein.

- APITURE DISCLAIMS ALL IMPLIED COVENANTS AND WARRANTIES OF ANY KIND IN CONNECTION WITH THE PAYRAILZ SERVICES, THE DOCUMENTATION, AND THE APITURE SYSTEM, INCLUDING ANY WARRANTIES OF QUALITY, MERCHANTABILITY, TITLE, NON-INFRINGEMENT, SUITABILITY, OR FITNESS FOR A PARTICULAR PURPOSE.

- Institution shall not copy, reproduce, modify, or make derivative works of or improvements or enhancements to the Payrailz Services and shall not, by any direct or indirect action or inaction, impair or alter the functionality of the Payrailz Services.

- Institution shall not cause or permit the reverse engineering, disassembly, translation, adaptation, or de-compilation of the Payrailz Services, or any attempt to derive source code or algorithms of the Payrailz Services, and shall not use the results of such processes.

- Institution shall be bound by its confidentiality and non-use obligations in the Apiture Agreement with respect to any information related to the Payrailz Services as furnished or disclosed by Apiture or its Payrailz Service to Institution.

- Institution shall comply fully with all relevant laws, rules and regulations.

- Institution shall not assign or sublicense its license to use the Payrailz Services except in the instance of assignment to affiliates or in connection with a sale of substantially all of the Institution’s business or assets.

- Institution does not have any right, title or interest (including intellectual property rights) in or to the Payrailz Services.

- Prior to granting access, all PR Users shall be bound by a written agreement with Institution that governs the terms of the use of the Payrailz Services, which such agreement shall contain, at a minimum, those terms set forth in Part II, Section 5 (below) of these Service Terms.

- Institution shall provide support to its PR Users regarding the Payrailz Services. Except for providing training and training materials to Institution to train its customer care representatives on the Payrailz Services, Apiture shall have no liability or responsibility for any support to Institution PR Users. Institution shall promptly notify Apiture of any issue requiring support from Apiture and provide Apiture with reasonable detail of the nature and circumstances of the incident. If an incident requires support from Apiture or Payrailz, Institution shall provide access to its network environment, facilities, personnel and contractors as necessary to effectively perform the support.

Neither Apiture nor Payrailz shall have any obligation to provide support for incidents that arise out of or result from, in whole or in part: (a) any fault or failure in any third party products or services; (b) use of the Payrailz Services in combination with any third party products and services; (c) negligence, abuse, misapplication or incorrect use of, or damage to, the Payrailz Services by Institution; (d) circumstances or causes outside of the control of Apiture or Payrailz, as applicable; (e) maintenance, updates, improvements or other modifications to the Payrailz Services by Institution; or (f) any breach by Institution of its obligations under the Apiture Agreement or these Service Terms. - Indemnification. Institution shall indemnify and hold harmless Apiture, Plaid and Payrailz, including their respective affiliates and officers, directors, shareholders, employees, representatives, agents, subcontractors, successors and assigns (the “Indemnified Parties”) from and against all claims of third parties, and any and all loss, damage, settlement or expense (including reasonable attorney’s fees and legal expenses) incurred by the Indemnified Parties to the extent arising out of (a) Institution’s gross negligence or willful misconduct in performing any of its obligations under its Apiture Agreement or these Service Terms, or (b) Institution’s breach of any of its representations, warranties, covenants or agreements under its Apiture Agreement.

- Fraud Monitor Service. Fraud Monitor is provided by Jack Henry & Associates, Inc. (“JH”) on an “AS IS” basis and JH makes no warranties, express or implied, with respect to Fraud Monitor. Fraud Monitor is a cloud-native, AI-based solution that detects multiple fraud attributes and indicators and generates an actionable score when payment transactions are initiated. Institution can configure score ranges and other thresholds based on their unique risk tolerance. JH shall not be liable for any damages incurred by Institution arising out of Institution’s use of Fraud Monitor, including but not limited to any fraud-related losses incurred by Institution. The data shared by Institution with the Deny List, if any, is shared globally with JH’s other customers on Fraud Monitor, and JH does not verify the accuracy of data on the Deny List.

- My Spending, Apiture IQ, PULSE, IAV & ID (Instant Account Verification) and MX Wealth Management

- Institution, for itself and its affiliates, authorizes Apiture’s Third Party Providers for the My Spending, Apiture IQ, PULSE, IAV& ID and/or MX Wealth Management Services (My Spending Service Providers) to utilize application programming interfaces between the Apiture System and My Spending Service Providers’ systems for My Spending Service Providers to perform data extraction and retrieval services that are (a) authorized by an Institution User, and (b) independent from performing My Spending Services for Institution. These extraction and retrieval activities are in place of Apiture’s Third Party Providers using a single data script (i.e. screen scraping) to extract and retrieve data residing on the Apiture System. For purposes of these Service Terms, the term “MySpending Services” refers to any one or bundle of My Spending, Apiture IQ, PULSE, IAV& ID and Wealth Management Services.

- Institution authorizes Apiture to provide My Spending Service Providers direct data feeds (via OFX version 2.2 or the current version of MDX) to/from Apiture Systems.

- Institution will enter into an agreement with each User using, at minimum, the terms set out in the User Agreement in Part II, Section 1 of these Service Terms or as otherwise approved by Apiture in connection with the My Spending Services.

- Apiture will use commercially reasonable efforts to work with My Spending Service Providers that provide data aggregation services for external accounts held-away at Institution or its third party financial institution(s) to provide functioning data aggregation services. Apiture makes no warranty that data aggregation services for external accounts held-away at Institution or its third party financial institution(s) will operate uninterrupted. Apiture will not be responsible for errors associated with data aggregation services for external accounts held-away at Institution or its third party financial institution(s), except for errors, the root cause of which, is attributable to Apiture’s My Spending Service Provider.

- Institution will:

- notify Apiture as soon as reasonably practicable of any unauthorized access to or misuse of the MySpending Services.

- permit Apiture or its My Spending Service Provider masked user account and transactional information through the channels requested by Apiture.

- provide Apiture with a financial account that: (i) contains all of the financial account types offered by Institution (i.e., checking, savings, loans, credit cards, line of credit, mortgage, investments, etc.), (ii) has test transactional data for each account type updated on a monthly basis throughout the term of the Agreement to enable continuous testing of transaction functionality within the My Spending Services, and (iii) allows testing from the required testing and production environments.

- in order to provide proper functionality, quality control, and to ensure the best user experience for the My Spending Services, cooperate with Apiture and its My Spending Service Provider to access, whenever reasonably requested by Apiture, User account information.

- Institution will not (a) make the MySpending Services available to anyone other than its authorized Users; (b) intentionally interfere with or disrupt the integrity or performance of the MySpending Services or third-party data contained therein, or (c) make any legally binding commitment, representation, or warranty on behalf of the My Spending Service Provider, or any of its affiliates, subcontractors or third party providers.

- Out of Band Token Authentication

- Apiture will provide Institution with the Service and related support services as set forth in these Service Terms to initiate and to maintain the Institution’s ability to provide the OoB Service to its authorized Users, who have agreed to Apiture’s Third Party Provider policy, referenced in Part II, Section 4 (below) and any other terms required by Apiture. Institution shall advise Users that they may incur additional charges from their telephone carriers and shall be solely responsible for such charges when sending and/or receiving any voice calls placed as part of the Token and Out of Band Token Authentication Services (collectively, OoB Services). The OoB Services include authentication hardware or software which displays a changing passcode. The changing passcode must be typed into an authentication screen by the registered User. The passcode is derived by a cryptographic process. Neither Apiture nor its OoB Third Party Provider shall be responsible to reimburse Institution or its Users for such charges including, but not limited to, inter-connection, access, termination, wireless, landline or any phone charges in the provision of the OoB Service.

- Institution shall not use the OoB Service to transmit or authorize: (i) junk mail, spam, or unsolicited material to persons or entities that have not agreed to receive such material or to whom Institution does not otherwise have a legal right to send such material; (ii) material or data that is illegal, harassing, coercive, defamatory, libelous, abusive, threatening, obscene, harmful to minors, excessive in quantity, or the transmission of which could diminish or harm the reputation of Apiture or its Third Party Provider or any network carrier involved in the provision of the OoB Service, including but not limited to material that is related to alcoholic beverages, tobacco, guns or weapons, illegal drugs, pornography, crime, violence, death, or any other questionable subject matter. Institution will not use the OoB Service in support of or for any illegal, fraudulent, or improper purpose, and will immediately notify Apiture if Institution learns of any unauthorized use of the OoB Services.

- Institution represents and warrants that: (i) Institution has obtained the necessary consents, right and licenses to, and authority over all data, required of registered Users necessary to lawfully provide to Apiture and permit Apiture to process the data as contemplated in the Agreement, (ii) Institution will use the OoB Service only in compliance with Legal Requirements including privacy and data protection requirements as well as applicable choice and notice requirements; (iii) Institution has reviewed Part II, Section 4 (below) and understands its obligations and will comply with these obligations; and, (iv) Institution will not use the OoB Service in support of or for any illegal, fraudulent, or improper purpose, and will immediately notify Apiture if Institution learns of any unauthorized use of the OoB Service.

- Institution will be responsible for record retention and for compliance with all applicable Legal Requirements with respect to the retention and reproduction of all documents and records related to the OoB Services.

- These Service Terms are expressly made subject to any laws, regulations, orders or other restrictions on the export from the United States of America of software, hardware, or technical information, which may be imposed from time to time by the government of the United States of America. Regardless of any disclosure made by Institution to Apiture of an ultimate destination of the OoB Service or the security credential, and, notwithstanding anything contained in these Service Terms to the contrary, Institution will not export, or re-export, either directly or indirectly, any part of the OoB Service, security credential or portions thereof, without first obtaining any and all necessary licenses from the United States government or agencies or any other country for which such government or any agency thereof requires an export license or other governmental approval at the time of modification, export, or re-export. Institution will be deemed to be the importer of record of for any portion of the OoB Service or security credential outside of the U.S., and shall be responsible for any related import filings, requirements, documentation, fees, taxes, duties, or other compliance obligations imposed by the applicable destination country or jurisdiction. Institution also agrees that it will not use the OoB Service or security credential for any purposes prohibited by United States law, including, without limitation, the development, design, manufacture or production of nuclear, missiles, or chemical or biological weapons.

- Institution understands that the OoB Service will be provided from Apiture using technology licensed by a Third Party Provider. Institution acknowledges that, in provisioning the OoB Service, Apiture and its Third Party Provider depend on the facilities, networks, connectivity and other acts of parties not under their control, including wireless carriers, government entities and network operators. NEITHER APITURE NOR ITS THIRD PARTY PROVIDER SHALL BE LIABLE FOR ANY INTERRUPTION, DELAY, SUSPENSIONS, AND OTHER ACTS AND/OR OMISSION BY SUCH PARTIES THAT ARE NOT WITHIN THEIR CONTROL.

- Institution will be deemed to be the importer of record of for any portion of the OoB Service or security credential outside of the U.S., and shall be responsible for any related import filings, requirements, documentation, fees, taxes, duties, or other compliance obligations imposed by the applicable destination country or jurisdiction. Institution also agrees that it will not use the OoB Service or security credential for any purposes prohibited by United States law.

- Institution’s authentication hard token orders are offers to purchase products subject to this Section of the Service Terms. All orders are subject to Apiture’s OoB Third Party Provider’s acceptance. Apiture’s OoB Third Party Provider may decline or cancel any order for any reason at any time. Apiture’s OoB Third Party Provider’s acceptance of Institution’s order is limited to these terms without any modification or exception. Additional terms and conditions on any purchase document (e.g., order) will have no effect (i.e., will not change or add to these terms whether or not Apiture’s OoB Third Party Provider specifically objects to those terms and conditions). Institution, on behalf of itself and any end customer for whom the product is purchased, consents to the transfer of Institution’s and any end customer’s email addresses, when such transfer is required to complete a transaction. Institution represents and warrants that all of Institution’s employees and agents placing orders on behalf of Institution are duly authorized to commit Institution. All accepted orders are binding. Institution may not cancel or amend any accepted order without Apiture’s written consent, except in the event of a material default by Apiture’s OoB Third Party Provider with respect to such order which has not been cured by Apiture’s OoB Third Party Provider within a reasonable period of time (not less than ten (10) days) following receipt of written notice from Institution of such default. Any cancellation by Institution permitted hereunder must be in writing and specify in reasonable detail the nature of the default. Orders for non-standard products, including products configured to Institution’s specifications, are non-cancelable and non-returnable. Apiture’s OoB Third Party Provider’s acceptance of Institution’s order occurs at time of shipment.

- Notwithstanding anything in the Agreement to the contrary, hard token orders may be purchased at the prices prevailing at the time of shipment, as determined by Apiture’s OoB Third Party Provider. Quoted prices are subject to change without notice and do not include taxes, handling, shipping, transportation, duties or other charges or fees.

- All deliveries of products will be made EX WORKS (Incoterms 2010) Apiture’s OoB Third Party Provider’s designated location. Risk of loss or damage to products will pass upon Apiture’s OoB Third Party Provider’s surrender of the products to the transportation provider. Institution assigns all rights in the receivables resulting from sales to its Users until Apiture receives full payment of amounts owed. Transportation charges will be on a “prepay and add” basis, unless otherwise agreed in writing by an authorized signatory of Apiture. Neither Apiture nor Apiture’s OoB Third Party Provider is responsible for spotting, switching, demurrage or other transportation charges unless agreed in writing. Neither Apiture nor Apiture’s OoB Third Party Provider is liable for any delays in delivery or for partial or early deliveries. Transportation charges will be in accordance with Apiture’s OoB Third Party Provider’s shipping policy at the time of shipment. If Institution directs Apiture to charge transportation fees to a third-party account number or to ship “freight collect”, Institution is responsible for all transportation and accessorial charges associated with the order and is responsible for product loss and damage in transit claims with the transportation provider. Neither Apiture nor Apiture’s OoB Third Party Provider is liable for any Institution requirements not stated in these terms. Institution or the consignee receiving delivery must accept deliveries and must inspect the products and secure written acknowledgement from the transportation provider for any shortages, loss, damage or nonconformance. Institution must notify Apiture in writing within two (2) days of receipt of any delivery of any shortages, defects or non-conforming products. In the event Institution fails to notify Apiture with such two (2) day period of any shortages, defects or non-conforming products, the products will be deemed accepted.

- Institution may only return products as permitted in these terms. Products otherwise will be non-returnable and the prices and fees will be non-refundable. Institution may only return erroneously shipped products or products that were damaged prior to shipment. Products damaged after shipment may not be returned. In order to be eligible to receive credit for returned products, Institution must adhere to Apiture’s OoB Third Party Provider’s then current returns processing guidelines. Institution must obtain a valid return authorization number (RMA) from Apiture’s OoB Third Party Provider for all returns prior to returning any product. Apiture’s OoB Third Party Provider has no obligation to issue RMAs. Institution is responsible for ensuring that the RMA is clearly visible on the address label of the product packaging and for complying with all other Apiture’s OoB Third Party Provider requirements provided to Institution when the RMA is issued. Unless otherwise agreed in writing by Apiture’s OoB Third Party Provider, all product returns from Institution are DDP (Incoterms 2010) Apiture’s OoB Third Party Provider’s designated facility, and title and risk of loss will transfer to Apiture’s OoB Third Party Provider upon receipt and acceptance of returned products at Apiture’s OoB Third Party Provider’s facility. If Institution desires to return any products, Institution must initiate a new order for the replacement products. Apiture’s OoB Third Party Provider may refuse delivery of any package without a valid, clearly visible RMA. All products erroneously shipped by Apiture’s OoB Third Party Provider must be returned with the original packaging intact (including manufacturer’s shrink wrap) and otherwise in unused, resalable condition. Credit, if any, will be provided for product returned in accordance with Apiture’s OoB Third Party Provider’s return policies at the time the RMA was issued, provided Institution is not in breach of any of these terms. If Institution returns any products without Apiture’s OoB Third Party Provider’s authorization or does not comply with Apiture’s OoB Third Party Provider’s return requirements, those products may be subject to return to the shipping location and, if refused, Apiture’s OoB Third Party Provider may consider the products abandoned and dispose of them, without crediting Institution’s account. Apiture reserves the right to charge a restocking fee for handling any product that is erroneously returned. Apiture’s sole liability for any returned products will be acceptance of their return and issuance of credits pursuant to Apiture’s OoB Third Party Provider’s then current returns processing guidelines.

- Institution acknowledges that neither Apiture nor Apiture’s OoB Third Party Provider is the manufacturer of the products. Product warranties, if any, are provided by the manufacturer or publisher (Vendor) of the products.

INSTITUTION WILL INDEMNIFY, DEFEND AND HOLD HARMLESS APITURE, APITURE’S OOB THIRD PARTY PROVIDER, ITS AFFILIATES, AND ITS VENDORS, AND EACH OF THEIR RESPECTIVE OFFICERS, DIRECTORS, EMPLOYEES, AND AGENTS FROM AND AGAINST ANY LIABILITIES, LOSSES, DAMAGES, COSTS OR EXPENSES OF ANY KIND (INCLUDING REASONABLE ATTORNEYS’ FEES AND DISBURSEMENTS) ARISING OR RESULTING FROM CLAIMS, DEMANDS, ACTIONS OR PROCEEDINGS OF ANY KIND ARISING FROM OR RELATING TO: (i) INSTITUTION’S USE, MARKETING, DISTRIBUTION OR SALE OF PRODUCTS IN A MANNER OTHER THAN AS SPECIFIED IN PRODUCT/SERVICE DESCRIPTIONS OR SPECIFICATIONS; (ii) APITURE OR APITURE’S OOB THIRD PARTY PROVIDER’S OR ITS VENDOR’S COMPLIANCE WITH DESIGNS, SPECIFICATIONS, OR INSTRUCTIONS PROVIDED BY INSTITUTION; (iii) INSTITUTION’S BREACH OF THESE SERVICE TERMS OR ACTS OR OMISSIONS OF INSTITUTION, ITS AFFILIATES, ITS AGENTS, OR THEIR RESPECTIVE EMPLOYEES, OFFICERS OR DIRECTORS; OR (iv) VIOLATION OR ALLEGED VIOLATION OF ANY APPLICABLE LAWS OR REGULATIONS BY INSTITUTION OR ITS AFFILIATES. - Neither Apiture nor Apiture’s OoB Third Party Provider will have liability for: (i) failure to allocate or reserve any product for Institution; (ii) failure to deliver products within a specified time period; (iii) availability and/or delays in delivery of products, (iv) discontinuation of products, product lines, or any part thereof; or (v) cancellation of any orders.

THE OBLIGATIONS OF APITURE’S OOB THIRD PARTY PROVIDER AND ANY AFFILIATE THEREOF, IF ANY, HEREUNDER ARE THE SEVERAL OBLIGATIONS OF EACH SUCH ENTITY, AND NOTHING HEREIN WILL BE DEEMED TO CREATE ANY JOINT AND SEVERAL LIABILITY BETWEEN OR AMONG APITURE’S OOB THIRD PARTY PROVIDER AND/OR ANY OF ITS AFFILIATES. - Institution agrees to adhere to Apiture’s OoB Third Party Provider’s and any of its applicable Vendor’s current Product Restrictions and Obligations Policy. Institution may not alter or modify the OoB Services in any way or combine the OoB Services with any other product or material not authorized by Apiture and/or its OoB Third Party Provider or the applicable Vendor. OoB Services may have additional restrictions on their distribution or use. Institution is solely responsible for ensuring its adherence to any and all such restrictions.

- Apiture’s OoB Third Party Provider is a distributor of “Commercial Items” as defined in FAR 2.101. Only the clauses in the Federal Acquisition Regulation (FAR) and agency FAR supplements which Apiture’s OoB Third Party Provider has agreed to and that are required to be inserted in a subcontract for Commercial Items, as set forth in FAR 52.244-6(c)(1) or an applicable agency FAR supplement apply to these Service Terms. Institution will receive only those rights in technical data provided by Apiture’s OoB Third Party Provider. In no event will Institution receive unlimited rights in data, software, or intellectual property rights provided by Apiture’s OoB Third Party Provider or its Vendors or any other third party.

- Notwithstanding anything to the contrary in the Agreement, if Apiture’s OoB Third Party Provider discontinues the general availability of the OoB Service or any features of the OoB Service, Apiture will provide Institution with at least two (2) months’ written notice of such discontinuance. Upon receipt of such notice, Institution; (i) shall provide notice to registered Users of such discontinuance; and, (ii) as applicable, Institution shall promptly cease distribution of any security credentials related to the OoB Service.

- Voice Authentication

- Voice One Time Password (OTP) Security Credentials are generated by a cryptographic algorithm that is delivered to the User’s phone through a call placed over a network carrier. The OTP value received is compared with the OTP value generated and provided to the User. If the OTP values match, the OTP security credential is authenticated before accessing and using any VA Services.

- Institution’s Users must register to use VA Services and accept a User Agreement which must meet the minimum requirements approved in advance in writing by Apiture and its Third Party Provider.

- Institution shall advise Users that they may incur additional charges from their telephone carriers and shall be solely responsible for such charges when sending and/or receiving any voice calls placed as part of the VA Service. Neither Apiture nor it Third Party Provider shall be responsible to reimburse Institution or its Users for such charges including, but not limited to, inter-connection, access, termination, wireless, landline or any phone charges in the provision of the VA Service.

- Institution acknowledges that, in provisioning the VA Services, Apiture and its Third Party Provider depend on the facilities, networks, connectivity and other acts of parties not under their control, including wireless carriers, government entities and network operators. NEITHER APITURE NOR ITS THIRD PARTY PROVIDER SHALL BE LIABLE FOR ANY INTERRUPTION, DELAY, SUSPENSIONS, AND OTHER ACTS AND/OR OMISSION BY SUCH PARTIES THAT ARE NOT WITHIN THEIR CONTROL.

- Institution will be responsible for record retention and for compliance with all applicable Legal Requirements with respect to the retention and reproduction of all documents and records related to the VA Service.

- In the event that Apiture’s Voice Authentication Third Party Provider discontinues general availability of any Voice Authentication Service (VA Services), Apiture will notify Institution of such discontinuance at least 60 days after Apiture’s receipt of any such notice. Institution shall thereafter cease using the VA Services.

- These Service Terms are expressly made subject to any laws, regulations, orders or other restrictions on the export from the United States of America of software, hardware, or technical information, which may be imposed from time to time by the government of the United States of America. Regardless of any disclosure made by Institution to Apiture of an ultimate destination of the VA Service or the security credential, and, notwithstanding anything contained in the Agreement or these Service Terms to the contrary, Institution will not export, or re-export, either directly or indirectly, any part of the VA Service, security credential or portions thereof, without first obtaining any and all necessary licenses from the United States government or agencies or any other country for which such government or any agency thereof requires an export license or other governmental approval at the time of modification, export, or re-export. Institution will be deemed to be the importer of record of for any portion of the VA Services or security credential outside of the U.S., and shall be responsible for any related import filings, requirements, documentation, fees, taxes, duties, or other compliance obligations imposed by the applicable destination country or jurisdiction. Institution also agrees that it will not use the VA Services or security credential for any purposes prohibited by United States law, including, without limitation, the development, design, manufacture or production of nuclear, missiles, or chemical or biological weapons.