By Missy Rose, Senior Product Manager

As community banks and credit unions work to attract small business clients, they are challenged to provide the full breadth of payment options these clients demand. According to new research from Datos Insights, 79% of small businesses want their primary financial institution to offer more payment options, as many institutions are not keeping pace with innovation in the payment space. Even more alarming, at least one-third of these businesses would switch or go to a new financial institution to get real-time payment options and better payment automation tools.

Real-time payment options such as FedNow® and RTP® are among the most in-demand capabilities for small businesses, as more than 80% of small businesses rank speed of payments an important requirement, according to Datos Insights.

Despite this sentiment, only 10% of businesses are using real-time payments today. It will take time for this option to diminish the popularity of checks, cards, ACH, and wires. To continue successfully supporting business clients, it is important to provide a range of existing payment methods and layer new, faster capabilities into your payment strategy.

Real-time payments offer clients more efficient, accurate money management, along with greater control and higher recipient satisfaction. This payment type also allows recipients to have conversations back and forth with the payer to ask questions or get help with reconciliation issues. Along with facilitating efficient, direct communications, payment-specific conversations live in perpetuity with the payment, allowing users to access this information when they need it.

This type of payment also offers real benefits to banks and credit unions, who can leverage faster payments to fund investment accounts or digital wallets; make payments to vendors, charities, or gig-economy workers; handle insurance payouts, real-estate closings, or CODs; issue course refunds to university students; or handle off-cycle payrolls including expenses, bonuses, or termination pay.

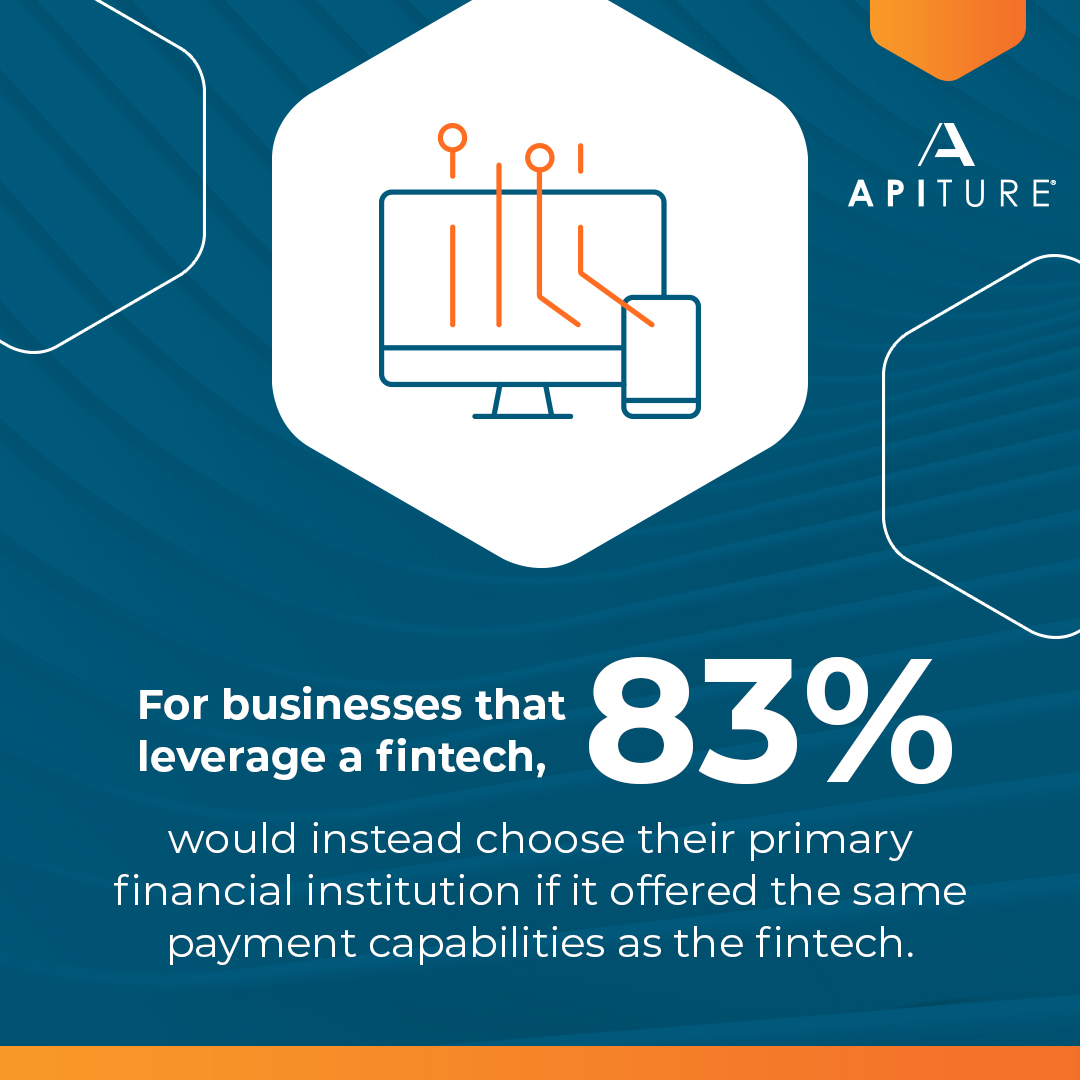

When financial institutions don’t provide real-time payment options, small businesses are increasingly turning to independent fintechs, such as Paypal or Venmo, to make payments in real-time or near real-time. However, among businesses who are already leveraging a fintech for faster payments, 83% admit that if their primary financial institution offered the same capabilities, they would instead look to that primary institution for these capabilities, according to Datos Insights.

Providing small businesses with the range of payment types they demand — including real-time payments — is an essential component of building loyalty and stickiness with these members and can ultimately drive value for them. Find out more about small businesses’ payment needs in Datos Insights report, Enhancing the Small-Business Payments Experience.