By Jennifer Dimenna, SVP Enterprise Partner Management

Recognizing how younger consumers prefer to bank is critical for financial institutions to stay competitive. Born between the early 1980s and 2010s, Gen Z and millennials have developed a digital-first outlook towards banking, as they grew up using the Internet, social media, and smartphones. To better understand millennnial and generation Z banking preferences, Apiture conducted original research with The Harris Poll examining more than 2,000 U.S. consumers.

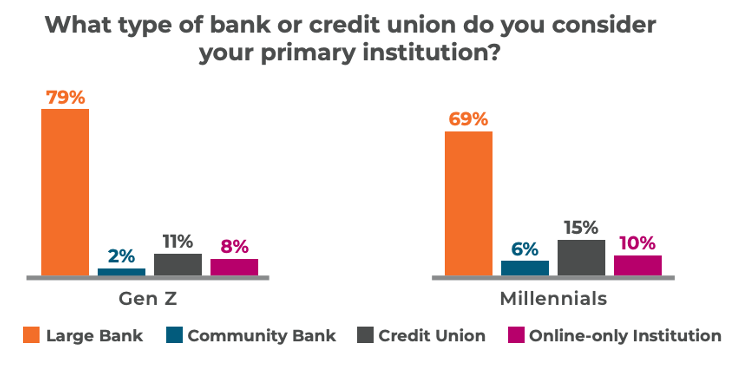

The research found that although 79% of Gen Z and 69% of millennials have chosen a large bank as their primary financial institution, roughly half of younger consumers are willing to switch to a community bank (52%), online-only institution (50%), or credit union (47%). This means community banks and credit unions have an opportunity to attract and retain younger consumers, but they must ensure they are meeting these users’ needs.

Banking Features Driving Gen Z and Millennials’ Demand

Modern digital banking tools and experiences are critical for attracting younger consumers, and a majority of these individuals say digital banking is at the core of their banking preferences, according to The Harris Poll. Features they prioritize are:

- Modern Digital Banking in Online and Mobile Platforms: Younger generations have grown up in an era of smartphones and instant access. Currently, 53% of Gen Z and 51% of millennials identify digital banking as a top need for choosing a new institution.

- Personalization: Having grown up with highly personalized experiences using apps like Amazon and Instagram, Gen Z and millennials prioritize tailored financial products and services.

- Digital Account Opening: The ability to open an account online or on a mobile device is an imperative for 41% of Gen Z and 38% of millennials when selecting a financial institution.

- Security: 60% of Gen Z and 54% of millennials identify top-notch security as a top factor when choosing a financial institution. Further, more than a quarter of Gen Z and millennials say they spread funds across multiple accounts to mitigate risk from fraud.

New Technology Trends Forcing Change

Several new technologies and features are worthy of your attention, as a sizeable percentage of younger consumers prefer institutions with these options. 25% of Gen Z and 22% of millennials are more likely to want a digital solution integrated with digital wallets and wearable devices, compared to 7% of baby boomers.

Other millennial and gen Z banking trends worth investigating are:

- Buy Now, Pay Later: users get what they need immediately but pay back over time in installments

- Skip a Pay: users can skip one or more loan or credit card payments with no impact to their credit score

- Family Banking: financial literacy tools that help teens and children become financially savvy and independent

- Digital Customer Support: enhancements to customer service — such as chat, video, or screensharing — that can help build loyalty with younger generations

Six Strategies for Meeting Gen Z Expectations

Other ways you can win over Gen Z and millennial consumers include the following:

- Implement intuitive mobile banking apps that allow users to bank anywhere, anytime. A PAYMNTS Intelligence study that studied Gen Z’s mobile banking habits learned the mobile banking channel is not just nice to have for these users — it’s a requirement — as Gen Z will switch financial institutions to get products and features that are highly mobile centric.

- Personalize the user experience through data and marketing solutions. With data analytics solutions and artificial intelligence tools, you can provide the right marketing offers to the right consumer at the right time. For example, you can use data insights to track younger customers with a certain balance threshold and target them with an ad to open a savings account or CD.

- Promote financial literacy. According to a Marketwatch survey, more than one-third of Gen Z and Millennials are looking to their banking institution for financial advice. Institutions that provide educational resources to help users manage money and improve spending habits and financial acumen will appeal to younger consumers. For example, Alabama Credit Union partnered with Apiture to implement a financial wellness strategy to meet its younger members’ needs, ultimately driving adoption of a credit monitoring tool by 38%.

- Invest in customer service[JT1] . Look for a digital customer support solution with a variety of popular tools, such as chat, video, and screen sharing, that offers users advanced features and seamless support.

- Enhance security on your digital banking platform. When you implement robust cybersecurity measures and fraud prevention methods, you can stop fraud before funds ever leave an account.

- Provide digital account opening and onboarding materials. According to a recent Javelin report, digital account opening is an imperative for Gen Z and millennials, and beyond that, users need continual exposure to relevant features and tailored content to get the most out of their digital banking experience. By offering digital account opening and ongoing onboarding, you can meet younger consumers where they are — online — while removing the need for new account holders to visit your branch to fulfill these tasks.

Define Your Strategy

Check out Apiture’s latest white paper, Attracting Gen Z and Millennials to learn more about honing your digital strategy to appeal to younger account holders. To learn more about how your financial institution can meet the needs of consumers of all ages, schedule a demo with Apiture.