How Peoples Bank of North Carolina is enhancing the digital experience for business and retail customers

Small businesses account for 99.9% of all businesses in the United States, and in North Carolina employ over 1.8 million people. In unpredictable times like those that we’re experiencing in the Coronavirus pandemic, small and mid-size business owners rely on their bank partner to provide consistent the digital experience they’ve come to expect, even outside of the branch.

Apiture spoke with Peoples Bank of North Carolina about their mission to provide exceptional customer experience to their business and retail customers, as well as their passion to help all of their customers reach their full potential.

Peoples Bank Director of Treasury Management, Avery Farley, has watched firsthand as the industry has grown with the advancements in technology over the last five years. Peoples Bank relies on Apiture to provide the commercial and retail digital solutions for their customers. “We need an online banking partner that can stay on the cutting edge of technology, making it easy to provide the best services to our customers.” Farley said. “At Peoples Bank, our customers see us as their ‘personal banker’ with the one-to-one experience and assistance we offer. We feel the same sentiment towards Apiture. I know that any questions or issues I have will be addressed and resolved immediately through Apiture’s customer success and support teams.”

Banking Reimagined

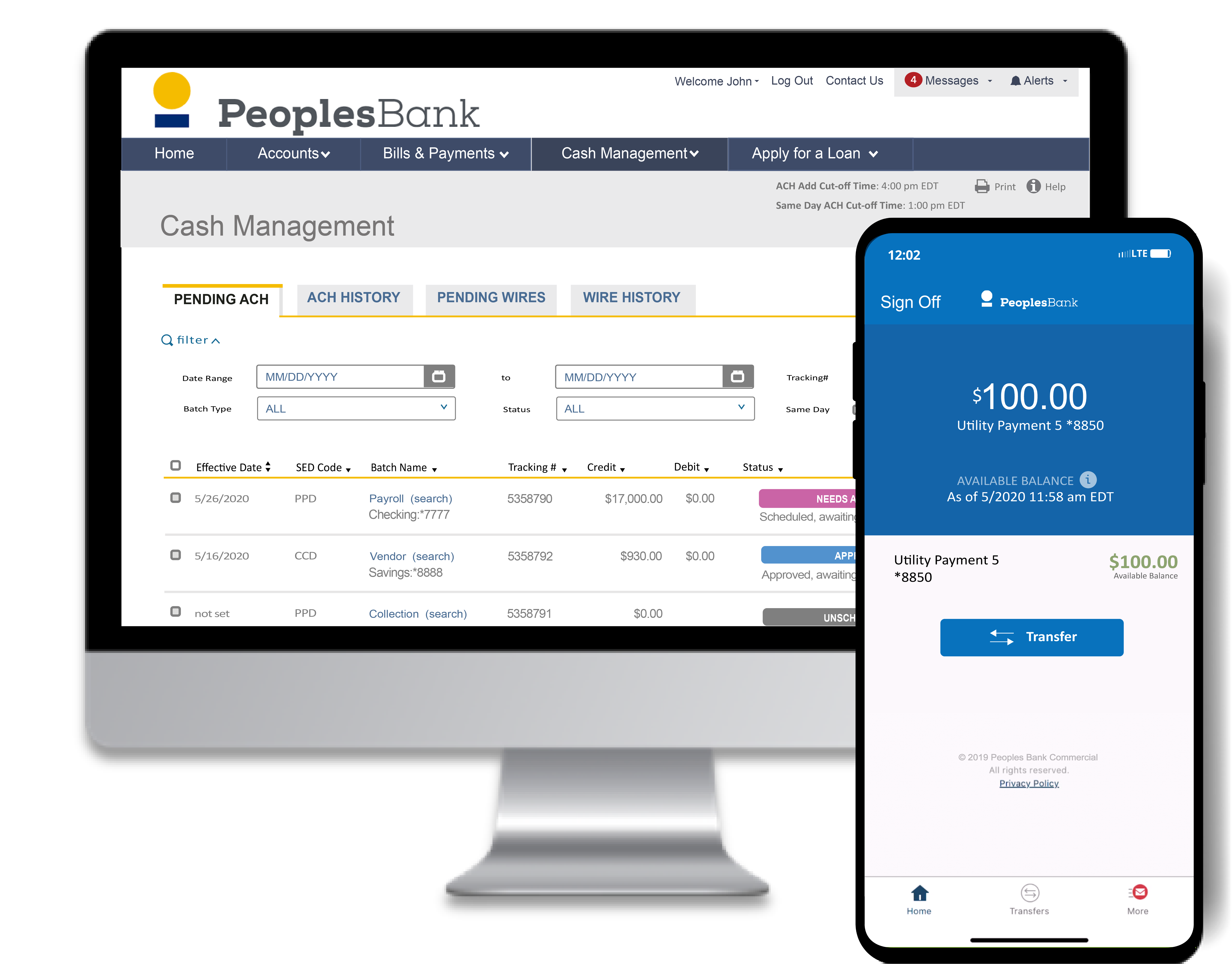

Peoples Bank recently worked with Apiture to launch a reimagined business banking mobile experience in addition to their already top-rated mobile application, with 4.8/5 stars on iOS and Android. Avery commented, “In today’s market, customers expect their digital services to be easy to use. For our customers to have so highly ranked our mobile application is really a sign of success that translates to our entire customer experience.

This enhancement will allow the bank to provide even more flexibility to their business banking customers. “With our commercial mobile banking app, we’re able to provide dual control to our cash management customers – giving them the ACH alert and wire approval option” Farley said. The next phase of the Peoples Bank commercial mobile experience is implementing Mobile Check Deposit, enabling the bank to provide business customers with a complete mobile banking experience in addition to their online offerings.

Better Business Banking

Peoples Bank has grown their cash management usage by 20% over the last two years, making it a key component of their business offering. Their new commercial mobile experience has seen a 35% average growth month-over-month since launching in Fall of 2019.

Businesses who bank with Peoples Bank of NC have access to digital options including Check & ACH Positive Pay, Reconcilement access, Wire Transfers, ACH Direct Deposit, Mobile Check Deposit, SSO Remote Deposit Capture, NACHA Imports, and more.

“Apiture’s new commercial platform enhancements have made banking easier for our business customers, so they can spend less time banking and more time running their businesses.” Said Farley.

As business and retail consumers alike increasingly rely on digital channels, Peoples Bank is prepared to continue to offer a seamless online and mobile experience for their users. Avery said, “We believe digital banking will continue to grow so it’s imperative that we have partners that will help us stay on top of this growth.”

A Future of Innovation

Peoples Bank is looking towards the future as they continue to enhance their digital offerings for their commercial customers. Peoples Bank is headquartered in Newton, North Carolina, with branch locations across North Carolina.