About Listerhill

Founded in 1952, Listerhill Credit Union services approximately 100,000 members across northwest Alabama and Central Tennessee, with a is headquarters in Muscle Shoals, Alabama. The credit union offers its members essential banking services, including checking and savings accounts, loans, and credit cards. Apiture has powered Listerhill’s digital channels for more than eighteen years. The credit union’s director of ecommerce, Jenny Casteel has been with Listerhill for more than 32 years, and she currently supports all digital channels, the contact center, call system, and more. We spoke with Jenny about Listerhill’s growth, its digital adoption, and her experience working with Apiture.

Focus on Digital Innovation

When the global pandemic began to make an impact in 2020, Listerhill — like many other financial institutions — was forced to quickly re-think its member experience. During the nationwide lockdown, Listerhill closed its branches and experienced a swift increase in digital adoption. Throughout 2020, the credit union reported an increase in adoption and usage across all digital channels. And when its branch lobbies closed, Listerhill also saw a quadruple increase of mobile check deposit usage when the federal government introduced supplemental checks.

“We closed all of our branch lobbies which pushed people towards our digital channels and we saw a spike in usage in every one of those channels.” – Jenny Casteel.

In addition to the growth of digital during the pandemic, Listerhill also has goals to expand its geographic presence. Over the next few years, Listerhill will expand into Limestone County in north Alabama and Spring Hill, TN to further increase its member base. As a result of this growth, the credit union plans to continue to focus on its digital experience, specifically in growing its member base through digital channels.

Using Custom Development to Fill a need

Because financial institutions know their members and customers best, they can often identify the right digital partner for their users’ needs. In this case, Listerhill wanted to expand its digital presence with third-party digital account opening and lending partner, Terafina.

Listerhill approached Apiture about this client development opportunity and Apiture worked with Terafina to create an integration that worked specifically for Listerhill’s needs. Even in a pandemic situation, Apiture completed the integration within the year. Apiture’s client development team works alongside clients to learn about their needs and then develops a solution that fits within the institution’s request and timeline.

“With the integration in place, our members can apply for a loan, apply for credit card, or open an additional account through our online and mobile applications. The process has gone very well,” Jenny said.

Once the branches reopened, Listerhill began leveraging the account opening integration at the branches. The front-line staff, including, tellers, call center, and lenders, were now able to help members with digital onboarding, allowing them to develop even better relationships with new and existing members.

A Better Mobile Experience

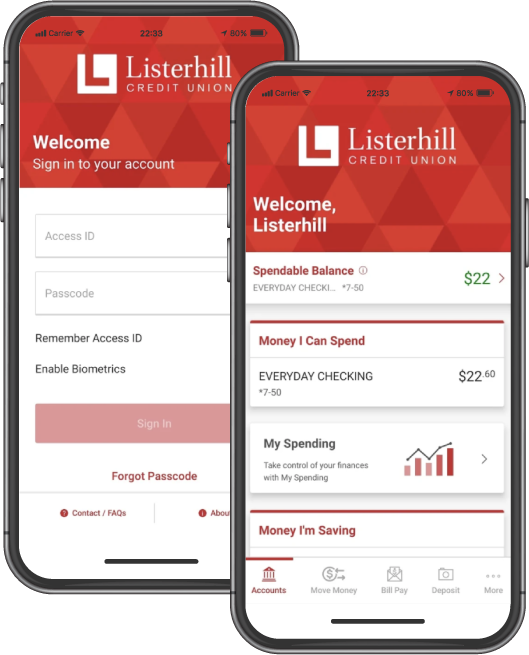

Listerhill lists the mobile experience as absolutely critical to its customers. “It’s the most important – we want our mobile app to do it all!”, Jenny said. In 2020, Apiture developed a new mobile application experience for bank and credit union customers, built entirely in-house. The new experience emphasized key design elements to enable a more fluid user adoption and experience and allowed more configuration options for the financial institution.

Listerhill Credit Union rolled out the mobile experience to its members in June 2021.

“We had a lot of positive feedback on the new mobile experience. I’ve even been contacted at home in the evening from members and employees telling me how much they enjoy the new application,” Jenny said.

The team at Listerhill is also looking forward to the flexibility and customization now possible from having a mobile application that is offered directly from the Apiture team.

A Dependable Channel

With the growing number of digital banking solutions on the market, Listerhill has remained with Apiture for 15 years because of its dependability and reliability.

“It’s a dependable channel for us – the platform very rarely experiences any downtime, and when there are any issues they are usually out of either of our control.” Jenny said. She said Apiture has been a great partner, allowing Listerhill to continue to grow and scale.

The post Case Study: Listerhill Credit Union appeared first on Apiture.