Bank of Prague and Apiture work together to provide a best-in-class digital experience

About Bank of Prague

Founded in 1906, Bank of Prague has embodied “Hometown Banking with your Neighbors and Friends” as their focus. By providing personal, professional, and premier service, Bank of Prague helps their customers achieve their financial goals. Bank of Prague’s leadership team understands that providing this premier service relies heavily on technology and digital channels, now, more than ever.

Apiture has been Bank of Prague’s partner throughout this digital journey for ten years. The past two years, specifically, have been proving ground for digital channels with the impacts of Covid-19 in shifting users to digital channels when in-person interaction was not possible.

We asked Jason Muessel, AVP and Catherine Hays, Cashier, for their insights into how this new digital shift has impacted Bank of Prague. “Digital channels are vital and essential to the delivery of technology and information to our customers. Small communities depend on services from community banks, and we must continue to adapt to our environment to meet the needs of our community,” Jason said, also emphasizing how Covid-19 only increased this demand.

Digital Innovation

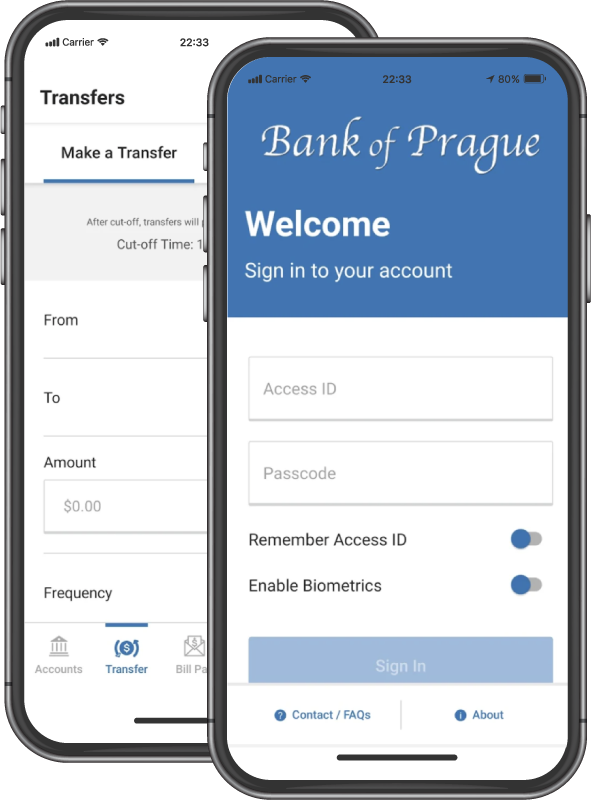

When it comes to financial technology, Bank of Prague trusts Apiture to deliver a best-in-class digital experience across their online and mobile channels. Bank of Prague delivers a leading customer experience by prioritizing the latest technology and process trends, setting standards, and being steadfast in project management.

Bank of Prague, like many other institutions, recognizes the upward trend in mobile banking and recently upgraded their mobile experience with Apiture’s new mobile application. The new experience enables Bank of Prague to have more control and ownership of their application and data. The mobile application rollout saw positive feedback from Bank of Prague users, namely because of its clean and modern interface, ease of navigation, and its speed.

Jason and his team are using Apiture’s enhanced analytics to propel their bank forward in their business plan. “Presently, we employ the following metric methods: Apple Analytics, Google Analytics, & Apiture Analytics Dashboards – we use the above-mentioned metrics to track the adoption of our digital data,” Jason said. Owning their data has enabled the Bank of Prague to articulate their business plan and growth strategy.

Premier Customer Service

On their partner in digital delivery, Jason explained, “Apiture has been a dynamic innovative company that has assisted in the scope of technology products at our bank. I continue to look forward to working with Apiture and relying on their guidance regarding the adapting landscape of tomorrow.”

While partnering on innovative online and mobile products has been successful for the Bank of Prague, Jason stated, “Customer service sold us on Apiture’s product(s) and excellent experiences have kept us loyal to the Apiture brand.”

Bank of Prague’s team likes building a relationship over time with an individual. That’s where Apiture’s Customer Success Manager (CSM) comes in. Each Apiture client has a dedicated CSM that is their point of contact and partner for everything regarding their Apiture services. The CSM relationship goes beyond service and enables a deeper understanding of each institution’s unique needs, challenges, priorities, and opportunities.

Bank of Prague’s team underscored that Apiture puts extra emphasis on satisfaction. Explaining that satisfaction is the end result of the care and understanding that Apiture crafts. “Customer satisfaction can be measured in different ways – I would suggest that Apiture delivers in each category,” Jason said.

The post Case Study: Bank of Prague appeared first on Apiture.